Two buyers can purchase the same property at the same price, yet end up paying dramatically different total amounts over time. The difference rarely comes from negotiation skill. It comes from how mortgage interest accumulates across years of ownership.

Mortgage interest is often treated as a background detail — a percentage quoted at approval, a monthly figure on a statement. In reality, it is one of the largest and most persistent cost drivers in property ownership. Small differences in rate, term, or structure can quietly reshape the total financial burden.

This article explains how mortgage interest really affects total property cost, focusing on long-term implications, compounding effects, and the trade-offs borrowers often overlook when making financing decisions.

What Mortgage Interest Represents Financially

Mortgage interest is the cost of borrowing capital to acquire property. It compensates lenders for:

-

Time value of money

-

Credit risk

-

Inflation expectations

-

Liquidity constraints

From the borrower’s perspective, interest is not a one-time fee. It is a recurring cost embedded into every payment, often persisting for decades.

While principal builds ownership, interest represents capital that does not convert into equity. Understanding this distinction is essential when evaluating total cost rather than monthly affordability.

Why Interest Has Outsized Impact on Total Cost

Interest affects property cost through three reinforcing mechanisms.

Duration

Long loan terms spread payments over time, reducing monthly strain but increasing total interest paid. The longer the repayment horizon, the more compounding works against the borrower.

Outstanding Balance

Interest is calculated on the remaining loan balance. Early payments are typically weighted heavily toward interest, meaning ownership builds slowly in initial years.

Rate Sensitivity

Even modest changes in interest rates can materially alter total cost. Central banks such as the Federal Reserve regularly explain how rate cycles influence borrowing conditions, which directly affects housing affordability over long periods.

Financial Requirements and Borrower Evaluation

Lenders do not price interest arbitrarily. Rates and terms reflect perceived risk and opportunity cost.

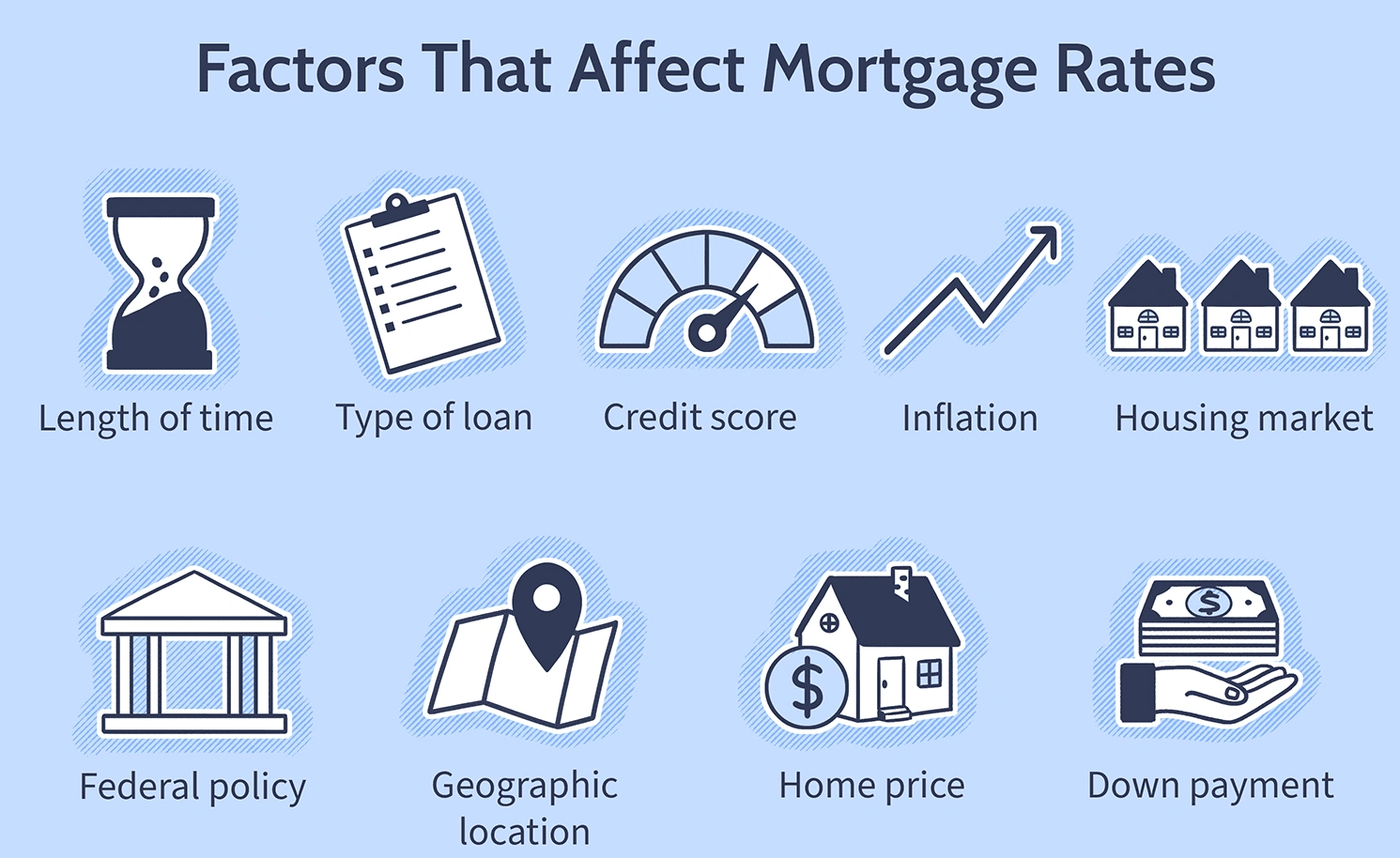

Key factors influencing mortgage interest include:

-

Credit history and repayment behavior

-

Income stability and debt exposure

-

Loan-to-value ratio

-

Property type and liquidity

Borrowers with higher perceived risk typically face higher interest costs, increasing total property cost even if purchase price remains unchanged.

How Mortgage Interest Accumulates Over Time

Early Years: Interest-Heavy Payments

At the beginning of most mortgages, a significant portion of each payment goes toward interest rather than principal. This structure protects lenders but delays equity accumulation for borrowers.

As a result:

-

Selling early often means limited principal reduction

-

Refinancing too soon may reset the interest clock

Mid-Term: Gradual Shift

Over time, as principal decreases, interest charges shrink proportionally. Payments begin to contribute more meaningfully to ownership rather than borrowing cost.

Later Years: Accelerated Equity Gain

Toward the end of the loan, most payments reduce principal. However, by this stage, much of the total interest cost has already been paid.

Fixed vs Variable Interest Structures

Fixed-Rate Mortgages

Fixed rates offer payment predictability. Total cost is easier to model, making long-term planning more straightforward.

Trade-offs include:

-

Higher initial rates in some environments

-

Reduced benefit if market rates decline

Variable or Adjustable Rates

Variable structures may start with lower rates but introduce uncertainty. Payment amounts can increase if rates rise, affecting affordability and total cost.

Global institutions like the Bank for International Settlements often highlight how variable-rate exposure increases borrower vulnerability during tightening cycles.

Hidden Cost Effects Borrowers Often Miss

Opportunity Cost

Capital used to service interest cannot be deployed elsewhere. Over long horizons, this foregone flexibility matters.

Refinancing Friction

Refinancing can reduce rates, but it involves fees, resets amortization schedules, and depends on market conditions.

Behavioral Impact

Lower monthly payments may encourage higher purchase prices, indirectly increasing total interest paid even at similar rates.

Long-Term Ownership and Exit Implications

Mortgage interest affects not only ownership cost, but exit outcomes.

-

Selling before meaningful principal reduction can limit net proceeds

-

High interest environments may suppress buyer demand

-

Refinancing constraints can restrict strategic flexibility

Data from organizations such as the OECD shows that housing markets can remain constrained for extended periods, increasing the importance of conservative interest assumptions.

Practical Ways to Evaluate Interest Impact

Rather than focusing on headline rates, experienced buyers often examine:

-

Total interest paid over the full term

-

Break-even points for refinancing

-

Sensitivity to rate increases

Questions worth asking professionals:

-

How much interest will be paid in the first five years?

-

What happens to payments if rates rise modestly?

-

How does a shorter term change total cost?

Reviewing full amortization schedules usually provides clearer insight than monthly payment figures alone.

Frequently Asked Questions

Does a lower interest rate always mean lower total cost?

Not necessarily. Fees, loan term length, and refinancing behavior all influence total cost.

Is paying extra toward principal always beneficial?

It can reduce total interest, but liquidity needs and opportunity cost should also be considered.

How much does interest matter if I plan to sell early?

Interest matters significantly in early years, when payments are interest-heavy.

Can inflation offset interest cost?

Inflation may reduce real value of future payments, but it also affects rates, expenses, and income unpredictably.

Conclusion: Interest Is the Silent Majority of Property Cost

Mortgage interest rarely feels dramatic, yet it often represents one of the largest components of total property cost over time. Focusing only on purchase price or monthly payments obscures how financing structure reshapes long-term obligations.

Understanding how mortgage interest really affects total property cost helps buyers and investors evaluate decisions more realistically — not by eliminating borrowing, but by recognizing its full financial footprint.

In property ownership, clarity about interest often matters more than optimism about price growth.