Property investments rarely fail because the asset is unusable. More often, the problem lies in when the decision was made relative to broader market conditions. The same building can feel like a low-risk opportunity at one point in the cycle and a financial burden at another.

Market cycles influence pricing, financing availability, rental demand, and exit liquidity simultaneously. Ignoring these dynamics does not eliminate their impact; it simply delays recognition until adjustments become costly.

This article explains how market cycles affect property investment decisions, focusing on how shifts in economic conditions alter risk, cost structure, and strategic flexibility for investors operating at different stages of experience.

What Market Cycles Mean for Real Estate

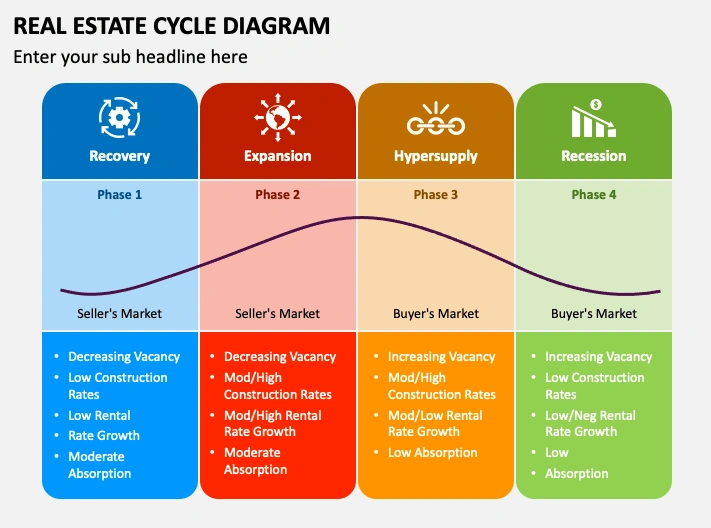

A market cycle describes the recurring phases of expansion, peak, contraction, and recovery that affect asset prices and economic activity. Real estate responds to these cycles more slowly than financial markets, but the effects tend to be deeper and longer lasting.

For property investors, market cycles influence:

-

Asset pricing and negotiation leverage

-

Availability and cost of financing

-

Tenant demand and rental growth

-

Exit timing and transaction liquidity

Unlike short-term volatility, cycles reshape the entire decision environment.

Core Phases of the Property Market Cycle

Expansion Phase

During expansion, economic growth supports rising demand for property. Rents increase, vacancy declines, and financing is generally accessible.

From a decision-making standpoint:

-

Pricing optimism becomes common

-

Underwriting assumptions trend aggressive

-

Competition compresses yields

Risk builds quietly as expectations rise faster than fundamentals.

Peak Phase

At the peak, asset prices often reflect optimistic assumptions about growth and stability. Financing may still be available, but underwriting becomes more sensitive.

Decision risks include:

-

Overpaying for stabilized income

-

Relying on continued rent growth

-

Ignoring downside scenarios

Peak conditions reward caution more than conviction.

Contraction Phase

Economic slowdown reduces demand, tightens credit, and pressures cash flow. Property values adjust slowly, often lagging broader economic signals.

Key effects include:

-

Reduced transaction activity

-

Higher refinancing risk

-

Greater importance of liquidity

Institutions such as the Federal Reserve frequently highlight how tightening monetary policy during contractions increases borrowing costs and refinancing stress for property owners.

Recovery Phase

Recovery follows adjustment. Pricing stabilizes, credit conditions gradually improve, and risk premiums normalize.

Opportunities often emerge here, but uncertainty remains elevated. Investors who preserved flexibility earlier are better positioned to act.

How Cycles Change Investment Decisions

Pricing Discipline

Market cycles affect what constitutes a “reasonable” price. Assets acquired late in an expansion may require longer holding periods to recover value, while those acquired during contraction face fewer competitive pressures.

Financing Structure

Loan terms shift with the cycle. During favorable conditions, leverage appears cheap and accessible. During stress, refinancing assumptions become critical.

Data from the Bank for International Settlements shows that leverage accumulated during expansion phases often amplifies losses during downturns, particularly in property markets with slow price discovery.

Cash Flow Expectations

Rental income responds unevenly to cycles. Some sectors experience delayed effects, while others adjust quickly.

Assuming steady cash flow across a full cycle exposes investors to:

-

Income shortfalls

-

Covenant pressure

-

Forced capital injections

Conservative cash flow modeling becomes more valuable as conditions tighten.

Cost Structure Sensitivity Across Cycles

Operating and financing costs do not move in tandem.

Common cycle-related cost shifts include:

-

Rising interest expenses

-

Higher insurance and tax burdens

-

Increased tenant concessions

Even modest cost increases can materially affect net income when margins are thin. Market-wide data published by the OECD illustrates how affordability pressures persist long after price corrections, affecting both tenants and owners.

Risks Investors Commonly Misjudge

Assuming Cycles Can Be Timed Precisely

Market cycles are observable in hindsight, not in real time. Attempting to time entries or exits perfectly often leads to delayed action or missed adjustments.

Overconfidence During Stable Periods

Extended stability encourages complacency. Investors may underprepare for volatility precisely when preparation matters most.

Ignoring Exit Liquidity

Liquidity declines sharply during downturns. Properties that seem easily sellable during expansion may face extended marketing periods later.

Practical Ways to Factor Cycles Into Decisions

Experienced investors incorporate cycle awareness without relying on forecasts.

Helpful practices include:

-

Stress-testing financing under less favorable conditions

-

Maintaining liquidity buffers beyond minimum requirements

-

Evaluating multiple exit scenarios

Questions worth considering:

-

How does this asset perform if rents stagnate?

-

Can obligations be met if refinancing is delayed?

-

Which assumptions rely on continued growth?

Cycle-aware planning does not eliminate risk, but it reduces forced decisions.

Frequently Asked Questions

Do market cycles affect all property types equally?

No. Different sectors respond at different speeds, though none are immune.

Is it better to wait for a downturn to invest?

Not necessarily. Opportunity depends on pricing discipline, financing structure, and holding capacity.

Can long-term investors ignore cycles?

Cycles still affect cash flow, financing, and exit options, even over long horizons.

How do interest rates interact with cycles?

Rate changes often accelerate cycle transitions by affecting borrowing costs and demand.

Conclusion: Market Cycles Shape the Rules of the Game

Understanding how market cycles affect property investment decisions helps investors recognize that risk is not static. The same strategy can behave very differently depending on broader conditions.

Rather than predicting cycles, disciplined investors focus on resilience: sustainable cash flow, conservative leverage, and flexibility under stress. In property investing, awareness of the cycle often matters more than confidence about direction.